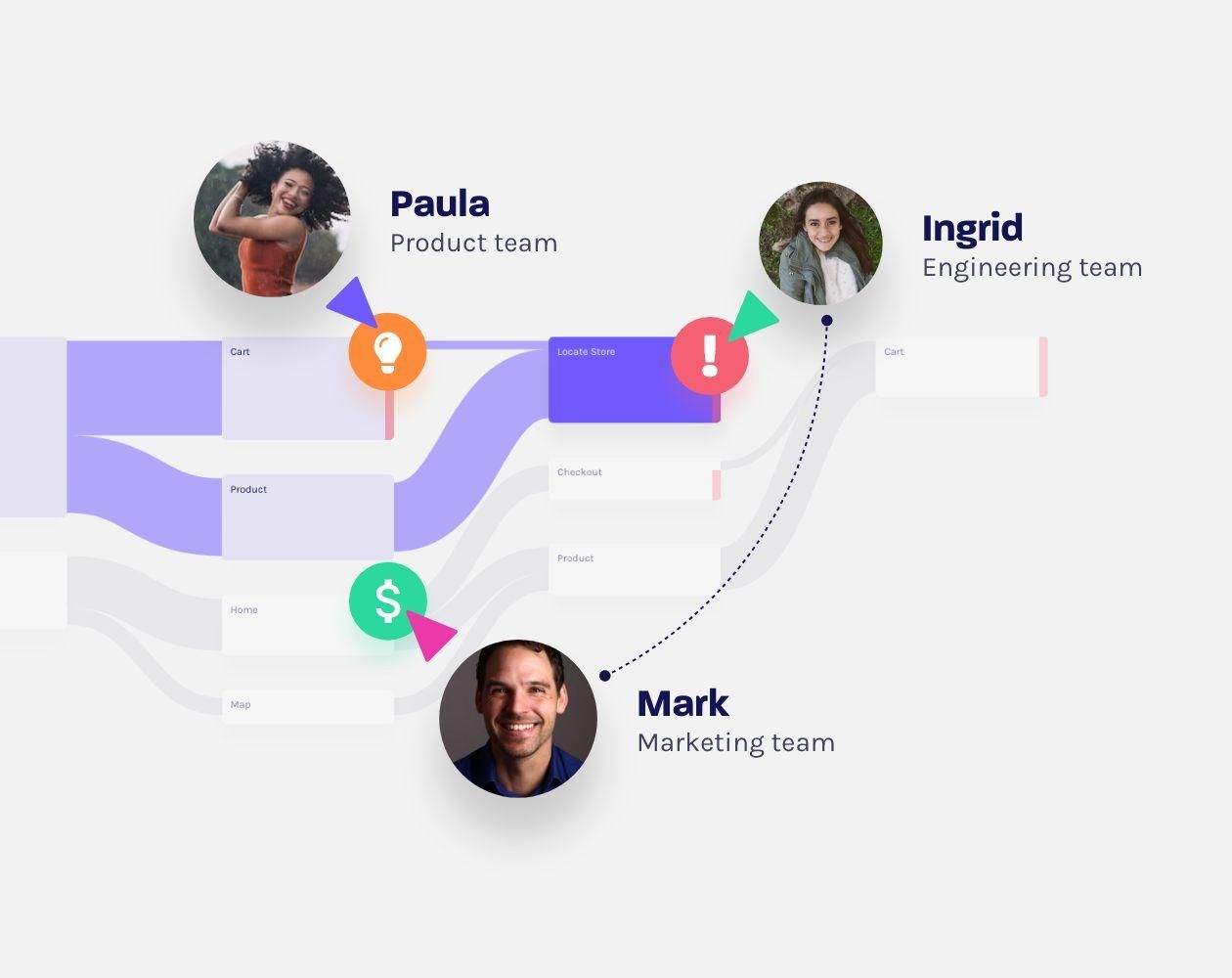

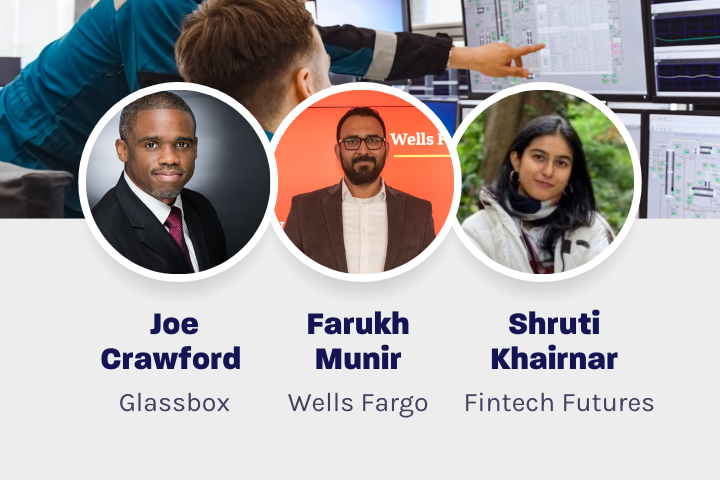

Unify your CX development efforts

Our digital experience platform makes it easy for teams across your organization to access a single source of truth about the digital banking, lending or payments customer experience. Precise insights, including complete session replays, can be shared between teams to enable a collaborative approach to problem-solving.